Our investment philosophy, rooted in acedemia and nurtured by real world experience, is designed to provide “optimal” before and after tax returns to investors.

We use the term “optimal” because our investment philosophy has at its origin in the Modern Portfolio Theory pioneered by Nobel Prize-winning economist Harry Markowitz. Modern Portfolio Theory (MPT) says that for every level of risk an investor is willing to assume there is an optimal asset allocation that is expected to produce the highest result. Mr. Markowitz is not affiliated with EMA.

We also subscribe to the efficient market hypothesis (EMH) that proposes that security markets are efficient at distributing and incorporating information into security prices. Simply put, the current price of any security incorporates all information currently known about the security and that no one individual can (unless he possesses inside information) know more than any other individual about the future performance of any security. Therefore, the theory asserts that no one can predict accurately over a statistically significant period of time, changes in stock prices.

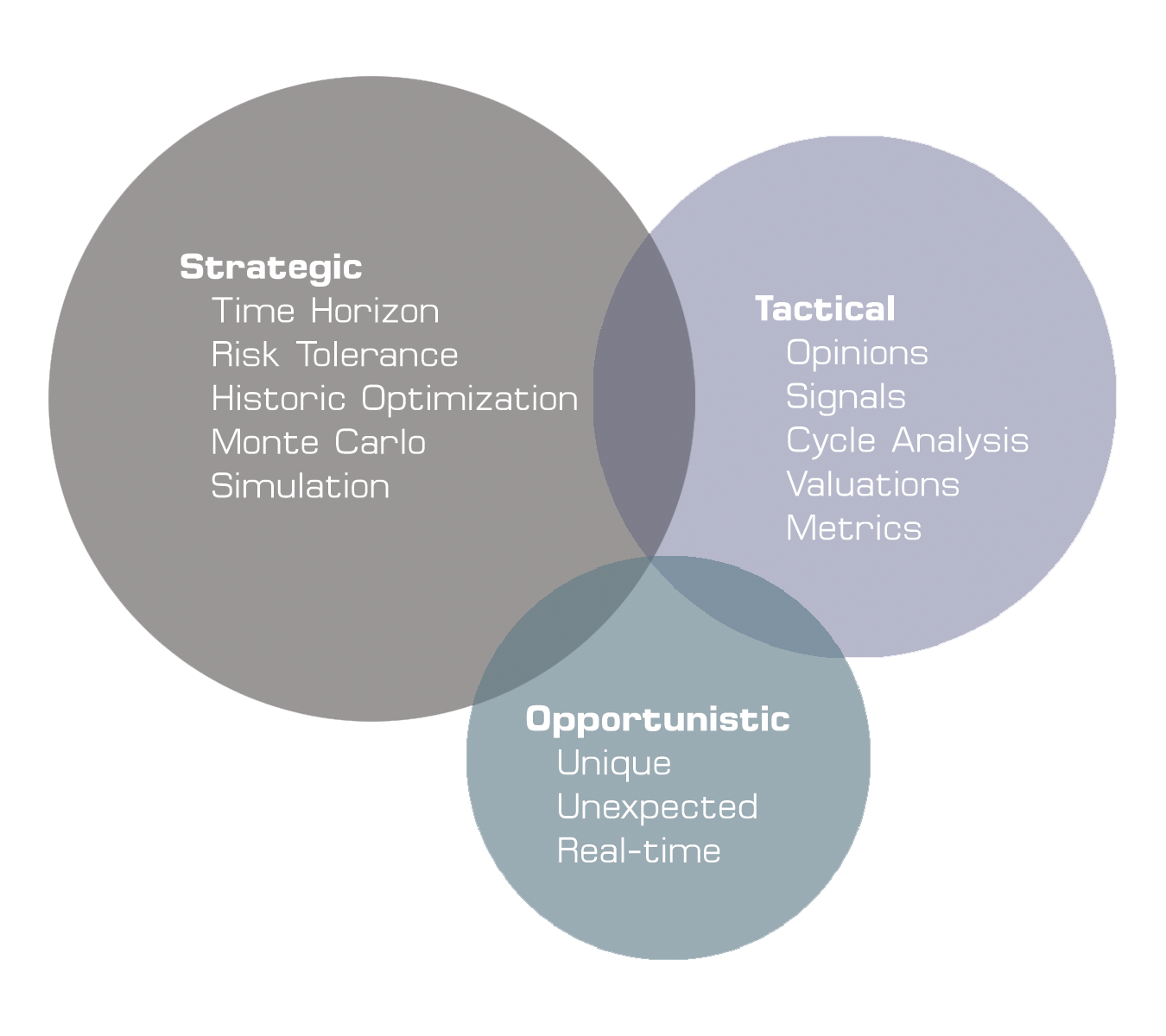

EMA believes in building portfolios that maximize returns without using higher-cost, actively-managed mutual funds, individual securities or cookie-cutter investment products. We don’t believe in “market timing.” Our proprietary approach is comprised of strategic, tactical and opportunistic elements using ETFs.

Strategic Asset Allocation considers an investor’s time horizon and the historical interrelationship of asset class prices irrespective of the current macroeconomic environment or the state of the business cycle.

Tactical Asset Allocation implements EMA’s investment views by adjusting the various asset weightings in a portfolio. EMA uses a top-down approach that considers multiple variables including relative valuation, economic cycle positioning, interest rate spreads, monetary and fiscal policy, political factors, yield curve analysis, and industry and sector valuations.

Opportunistic Investing provides the potential to add “alpha” or value to a portfolio by maintaining the flexibility and willingness to act when unexpected events occur that cause over or under valuations of an asset class, sector or industry.

We utilize Exchange-Traded Funds (ETFs) in client accounts. ETF’s are tax-efficient because their holdings are not actively traded, thereby minimizing realized gains which must be distributed. ETFs are constructed to perform nearly identically to an unmanaged index. Trading activity may occur in an ETF when securities are added or removed from an index. Because our clients own ETFs exclusively they can expect lower annual capital gains distributions. We also review each account annually to identify possible “swap” opportunities where clients are carrying a position at a higher cost basis than the current market value. For example, if an investor owns one Large Cap ETF and his/her cost basis is above the market value, then we may swap it for another Large Cap ETF which tracks a similar but not identical index. This is known as “tax loss harvesting.” When rebalancing occurs in a client account, we will be selling off some shares of the asset class that has risen the most in their portfolio. This may result in a tax liability for a taxable account.

Investors often overlook the internal expenses of a mutual fund they own. Typically expenses of actively managed mutual funds run in the neighborhood of 1.5% per year. What most people do not know is that the expense ratio published by a mutual fund in its prospectus does not fully account for all expenses. For example, the commissions that the fund pays to buy and sell securities are not included in the expense ratio. If these commissions were included they would add to the fund’s expenses. Exchange-Traded Funds not only carry low expense ratios but because they trade their securities infrequently, incur very little in the way of internal commission costs.

A critical component to success in investing is to follow the age-old maxim “buy low and sell high.” Unfortunately, for most investors this is more easily said than done. Rebalancing is the process of selling portions of one’s investment in a particular asset class or security that has grown as a percentage of the portfolio to a level beyond its intended or target allocation. Proceeds from the sale are used to buy additional portions in another asset class or security that have fallen below its intended target allocation. In other words, “buying low and selling high.”

For example, studies have shown that periodically rebalancing an investment portfolio between different asset classes such as stocks, bonds and real estate can significantly reduce the overall risk or volatility in a portfolio. For many investors, this means a smoother ride towards their financial goals making the process of investing less emotional. Not only can rebalancing between asset classes and investment styles reduce your portfolio’s volatility, it may also enhance its returns over time.

One hypothetical investor’s portfolio starts out in 1994 with 60% stocks and 40% bonds. By the end of 1999 stocks had grown to represent nearly 80% of this investor’s portfolio. Going into the years 2000, 2001, and 2002, an allocation of 80% stocks would have been very painful. Had the portfolio been rebalanced periodically, this investor would have entered the bear market with less exposure to stocks.

A second portfolio starts out in 2000, again with 60% stocks and 40% bonds. Because this investor did not rebalance his portfolio, his stock allocation dropped to only 40% by the end of 2002. Had this investor periodically rebalanced his portfolio back to the original 60% stocks and 40% bonds weighting, he would have had a greater weighting in stocks going into the bull market of 2003.