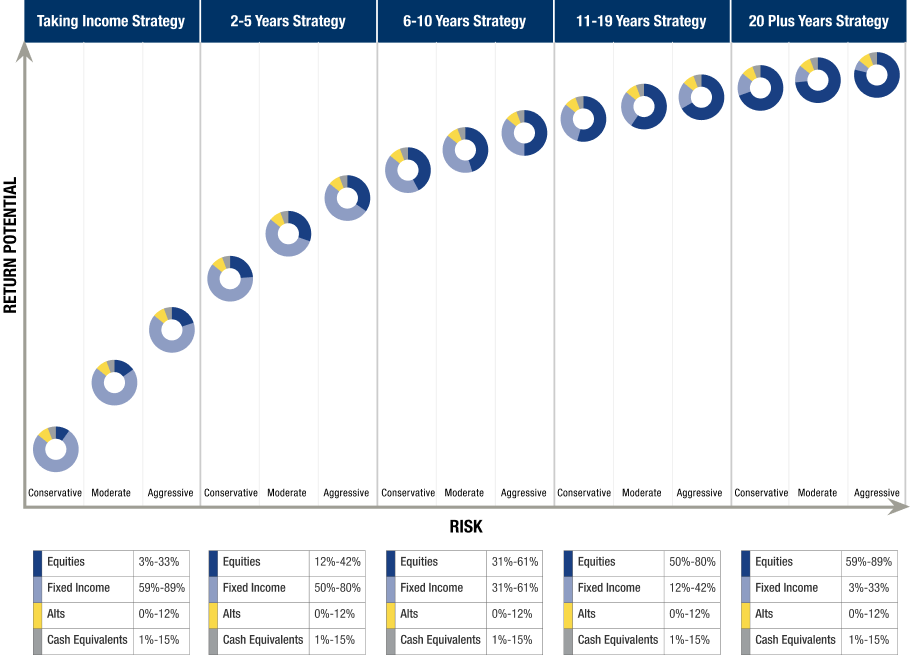

Cantor Fitzgerald Managed ETF Portfolios

Managed and consistent cash flow ETF portfolios may be an excellent investment option for individuals, institutions, and endowments that are looking for an institutional consultant style of investment management. Cantor Fitzgerald Managed ETF Portfolios seek to deliver risk and return characteristics that are broadly similar to policy driven portfolios such as university endowments and governmental pension plans.

The Cantor Fitzgerald ETF strategies provide investors with highly diversified asset class exposure comprised of strategic, tactical, and opportunistic asset allocations with strategies offered in both traditionally managed and Environmental, Social, and Governance (“ESG”) formats.